EBRI: Auto-Enrollment Trend Boosts Retirement Readiness Ratings

May 24, 2012

More than half of Baby Boomers and Generation Xers are projected to have adequate retirement income to cover basic expenses and uninsured health care costs, according to the latest projections by the nonpartisan Employee Benefit Research Institute (EBRI).

More than half of Baby Boomers and Generation Xers are projected to have adequate retirement income to cover basic expenses and uninsured health care costs, according to the latest projections by the nonpartisan Employee Benefit Research Institute (EBRI).

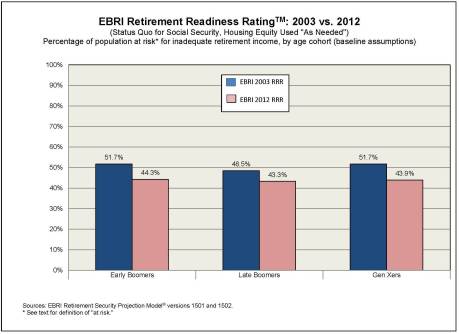

While roughly 44 percent of Baby Boomers and Generation Xers are still projected to be “at risk” of running short of money in retirement, that’s still some 5–8 percentage points better than what was found in 2003, largely due to the increased adoption of auto-enrollment plan design features by 401(k) plan sponsors. “These latest results are a significant improvement,” noted Dr. Jack VanDerhei, EBRI research director and author of the report. The new EBRI projections, based on its proprietary Retirement Income Security Projection Model® (RSPM), update previous estimates from 2003.

According to the RSPM, lower-income households remain at greatest risk of insufficient retirement income: 87 per-cent of retired lowest-income households are projected to be at risk, compared with 13 percent of highest-income households. EBRI’s analysis finds that the aggregate national retirement income deficit number, taking into account current Social Security retirement benefits and the assumption that net housing equity is utilized “as needed,” is currently estimated to be $4.3 trillion for all Baby Boomers and Gen Xers.

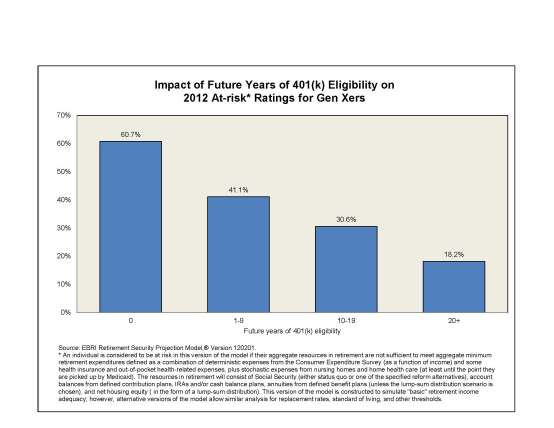

Eligibility for a workplace defined contribution retirement plan was found to have a significant positive impact on these “at risk” levels: Simulation results show that Gen Xers with no future years of eligibility would run short of money in retirement 60.7 percent of the time, whereas fewer than 1 in 5 (18.2 percent) of those with 20 or more years of future eligibility would run this risk.

EBRI’s updated 2012 RSPM looks at Early Baby Boomers (individuals born between 1948–1954), Late Baby Boomers (born between 1955–1964), and Generation Xers (born between 1965–1974), to determine each group’s likelihood of running short of money to cover basic expenses and uninsured health costs in retirement.

EBRI’s analysis also provides Retirement Savings Shortfalls—the additional amount that individuals would have save by age 65 to eliminate their expected deficits in retirement—by age group, family status, and gender for both Baby Boomers and Gen Xers. For those on the verge of retirement (Early Boomers), the average cash shortfalls at retirement age range from approximately $22,000 (per individual) for married households, to $34,000 for single males and $65,000 for single females. However, when taking into account only those projected to run short of funds, the average shortfalls at retirement age are higher: approximately $70,000 (per individual) for married households, $95,000 for single males and $105,000 for single females.

The full report is published in the May 2012 EBRI Notes, “Retirement Income Adequacy for Boomers and Gen Xers: Evidence from the 2012 EBRI Retirement Security Projection Model,®” online at www.ebri.org

You must be logged in to post a comment.